Below is a sample financial aid offer so that you can get a sense of what yours will look like. If you already have one, we recommend having it on hand so you can understand the different sections.

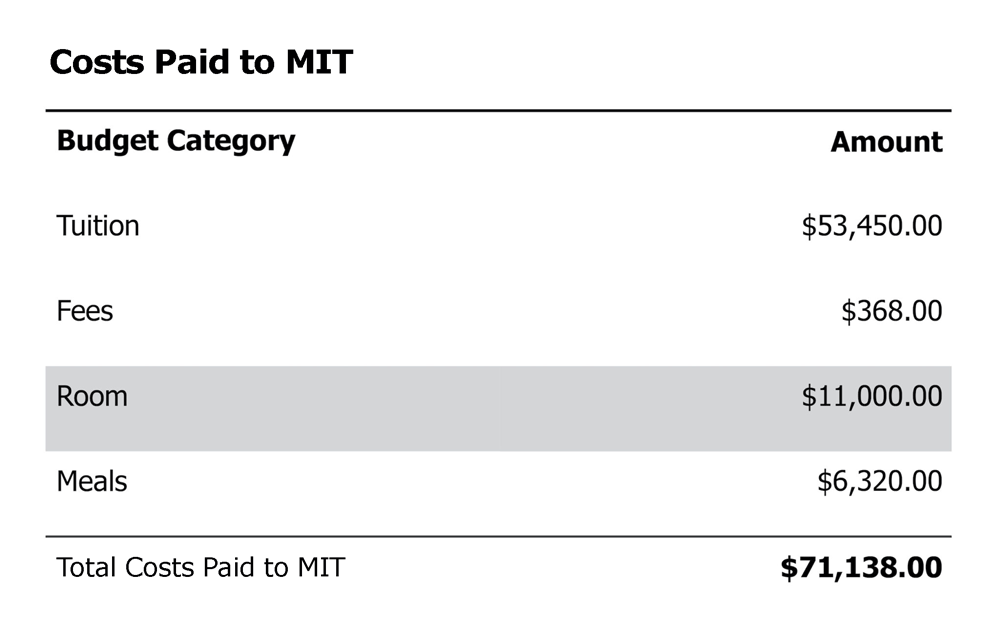

Costs paid to MIT

These are expenses that you or your family pay to MIT. Housing and food costs will vary depending on where you live on campus and which meal plan you choose.

- Graphics are taken from a sample award.

Note: If you are living off campus, your room and meals would be classified as costs paid to others.

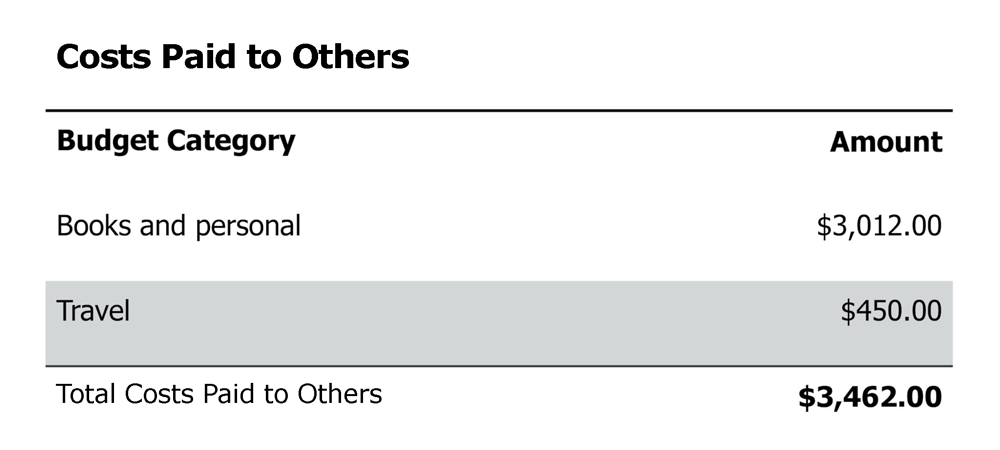

Costs paid to others

These are expenses for college that are paid to providers other than MIT, such as books, clothing, or travel to and from campus. The amounts on your financial aid offer are estimates of what you can reasonably expect to spend during the academic year.

*Travel allowance is calculated using your permanent address, and aims to cover two round trips per year.

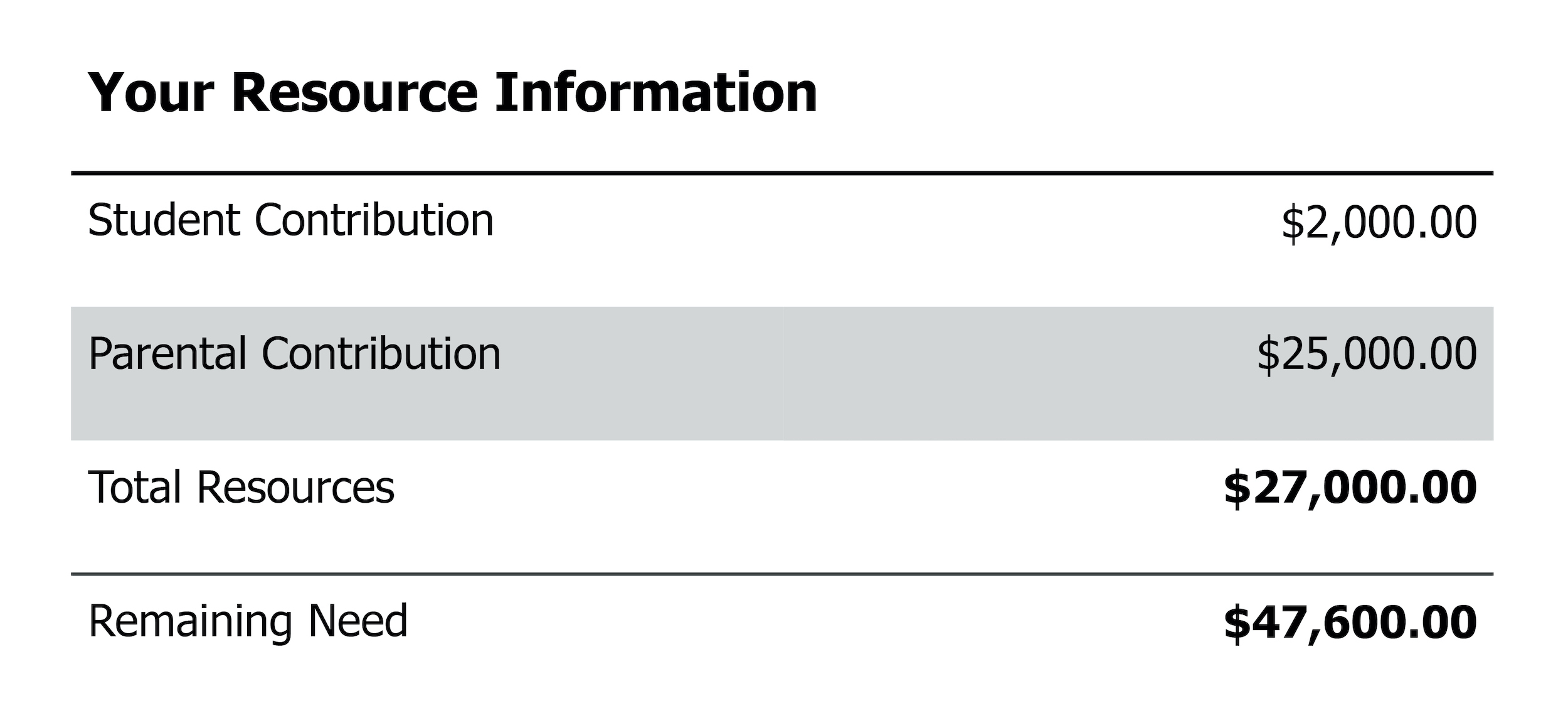

Your resource information

Your resource information is the amount you and your family can contribute toward your education and related expenses.

- Student contribution: The amount that you can reasonably be expected to contribute toward your educational expenses. Your student contribution is the amount that you can reasonably be expected to save from working over the summer. You may also use outside scholarships to meet this expectation.

- Parent contribution: The parent contribution is based on our assessment of your family’s financial circumstances and ability to pay.

- Total resources: The amount that we believe you and your family can contribute toward your education and related expenses.

- Remaining need: The amount of financial need that will be covered by various grants, scholarships, student employment,01 the amount you would earn working 8–10 hours per week during the semester and loans. This amount is based on subtracting the total that you and your family pay (total resources) from the total cost of attendance (sum of direct and indirect costs).

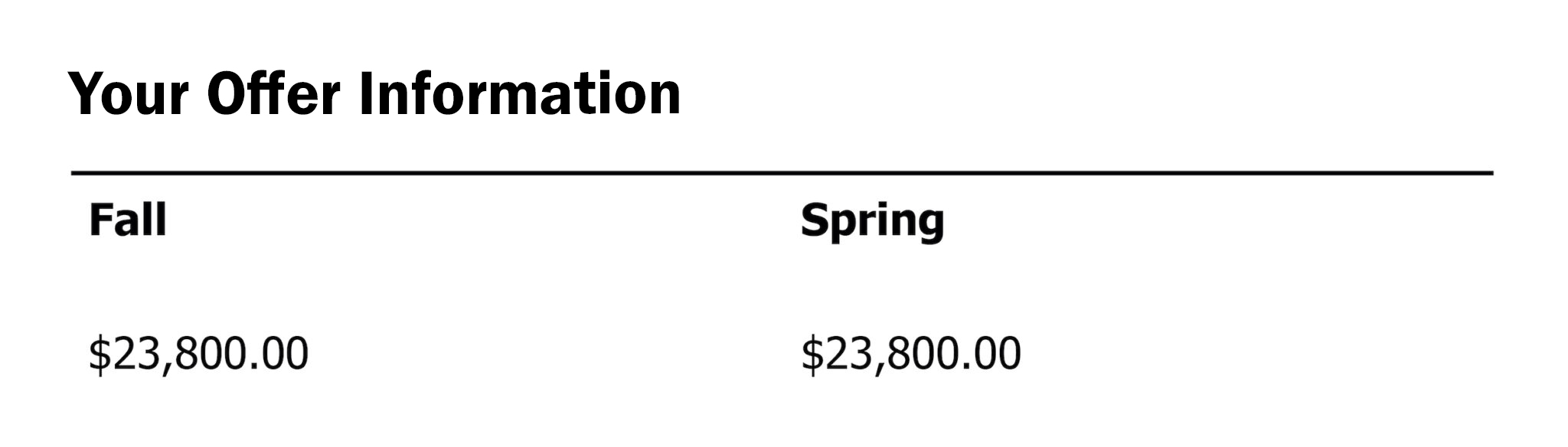

Your offer information

Below is a list of aid currently given to you by each term. This aid is contingent upon your meeting all enrollment, federal, state, and institutional requirements for eligibility.

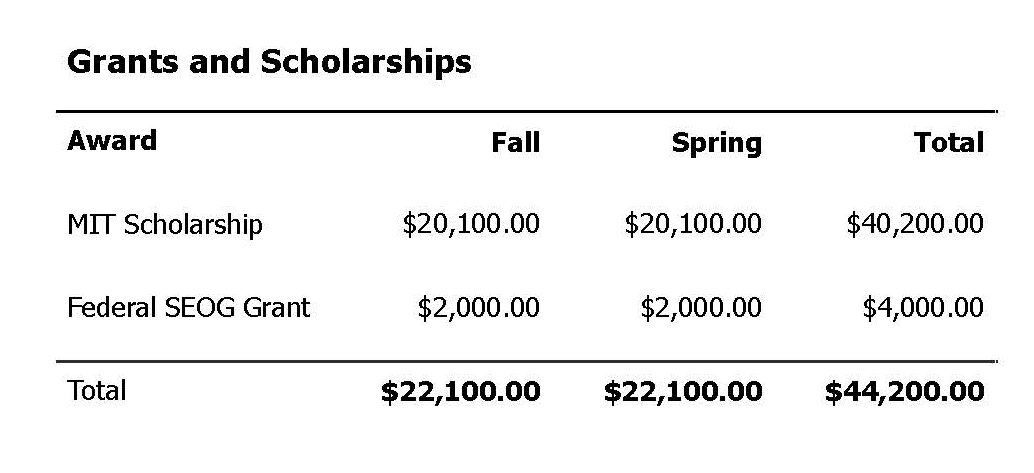

Grants and scholarships

Grants and MIT Scholarships are gift aid that do not need to be repaid and are based on financial need.

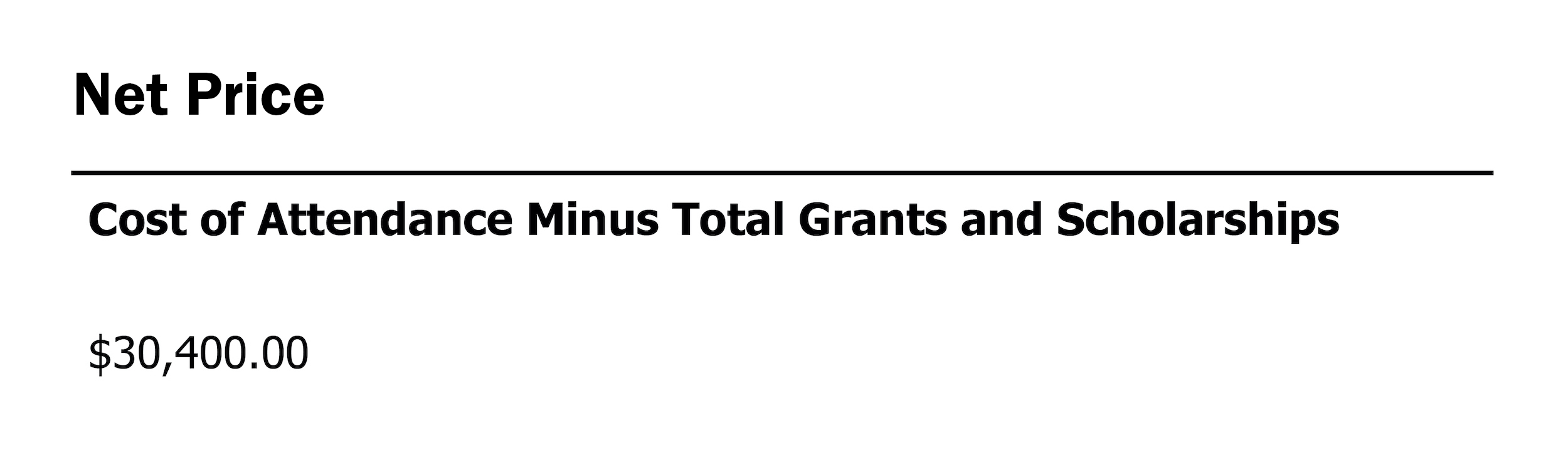

Net price

Your net price is the amount remaining after all of your financial aid is applied to the cost of attendance.

[Total costs] – [Total grants and scholarships] = What you should expect to spend for the year

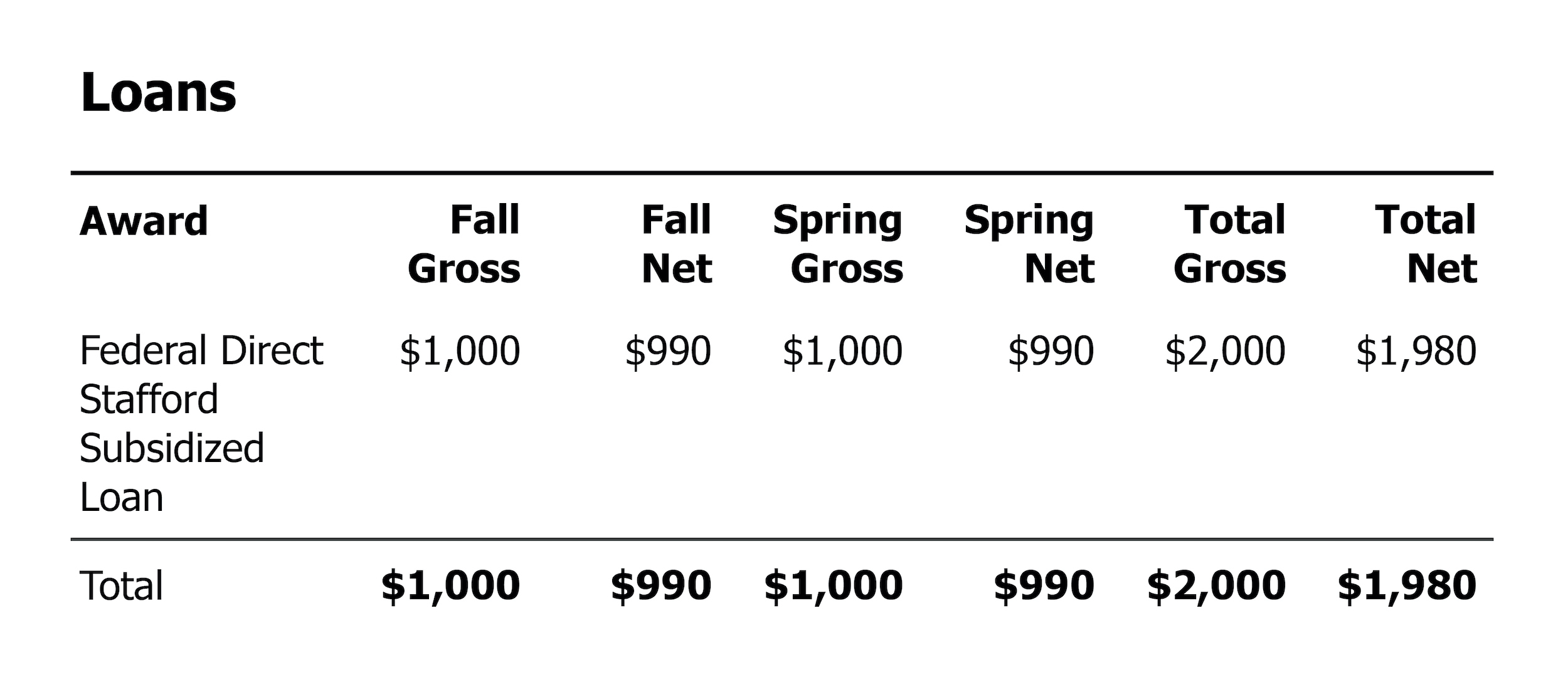

Loans

The net loan amount is the amount of money you actually receive. The gross loan amount is the total loan before the origination fee is subtracted. The origination fee is essentially a processing fee charged by the lender.

Student employment

This is considered a part of your financial aid. You will see a suggested amount on your offer letter that can be earned by working during the school year. You can cover your student employment through a combination of term-time work, outside scholarships or grants (including Pell Grants), or student loans. Your MIT Work requirement varies based on how much you are taking out in loans. If you have loans, your MIT Work expectation decreases.

You can also meet this requirement with a UROP or other job during the fall and spring semesters. Although we encourage MIT students to consider term-time work as one of the ways to meet the student contribution, some students prefer maximizing their student loan eligibility.

Questions?

If you have any questions about your financial aid offer, our financial aid counselors are always available to help. Counselors are assigned by last name, and you can contact them using the information on our contact page.

- the amount you would earn working 8–10 hours per week during the semester back to text ↑